Co-author: Reizle Platitas

This post draws from a paper presented in the ACAES session on "Asian Economies in Global Supply Chains" at the 2023 Allied Social Science Association Annual Meeting, program here.

Asia’s exports doubled from 16% of GDP in 1990 to 34% in 2008, driven by the global fragmentation of production processes. After 2008, however, exports-to-GDP moderated, reflecting what some have dubbed slowbalization. This reality, however, conceals much heterogeneity: the slowdown was largely driven by falling commodity prices and by China becoming more self-reliant. Given the persisting role of cross-border value chains for Asian economies, understanding their dynamics remains crucial to strengthening the resilience of these economies.

This post highlights how cross-border value chains withstood the disturbances that have affected Asia since 2016. During this period, trade tensions mounted between China and the US. Escalation of tariffs paused in 2020, but cross-border value chains were then hit again by the COVID-19 pandemic.

Typically, analysis of trade flows relies on gross merchandise trade data. But such data can be misleading as gross export measures involve double counting of value added. In contrast, our analysis draws on the Multiregional Input-Output database of the Asian Development Bank, which allows computation of the value added composition of trade with differentiation between final goods and intermediates.

Regionalization intensified with China-US trade tensions in 2016–2019

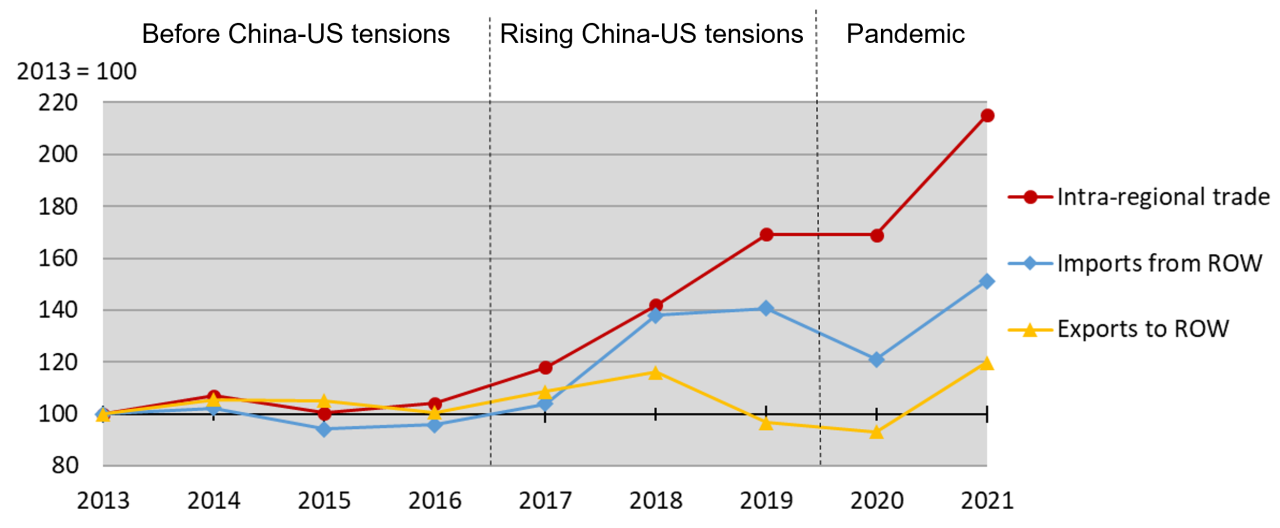

Trade in intermediates soared in developing Asia as China-US tensions escalated, led by Chinese exporters sourcing from within the region. Intra-regional trade in intermediates rose by 63% in value added terms during 2016–2019, as shown in Figure 1. By contrast, imports of intermediates from the rest of the world rose only 47% while exports of intermediates to the rest of the world fell by 4%. This rise in intra-regional trade in intermediates was largely driven by regional exports to China, which rose by 81%.

|

Figure 1. Value-Added Trade in Intermediates in Developing Asia, 2013-2021 Data source: Asian Development Bank, Multiregional Input-Output database. |

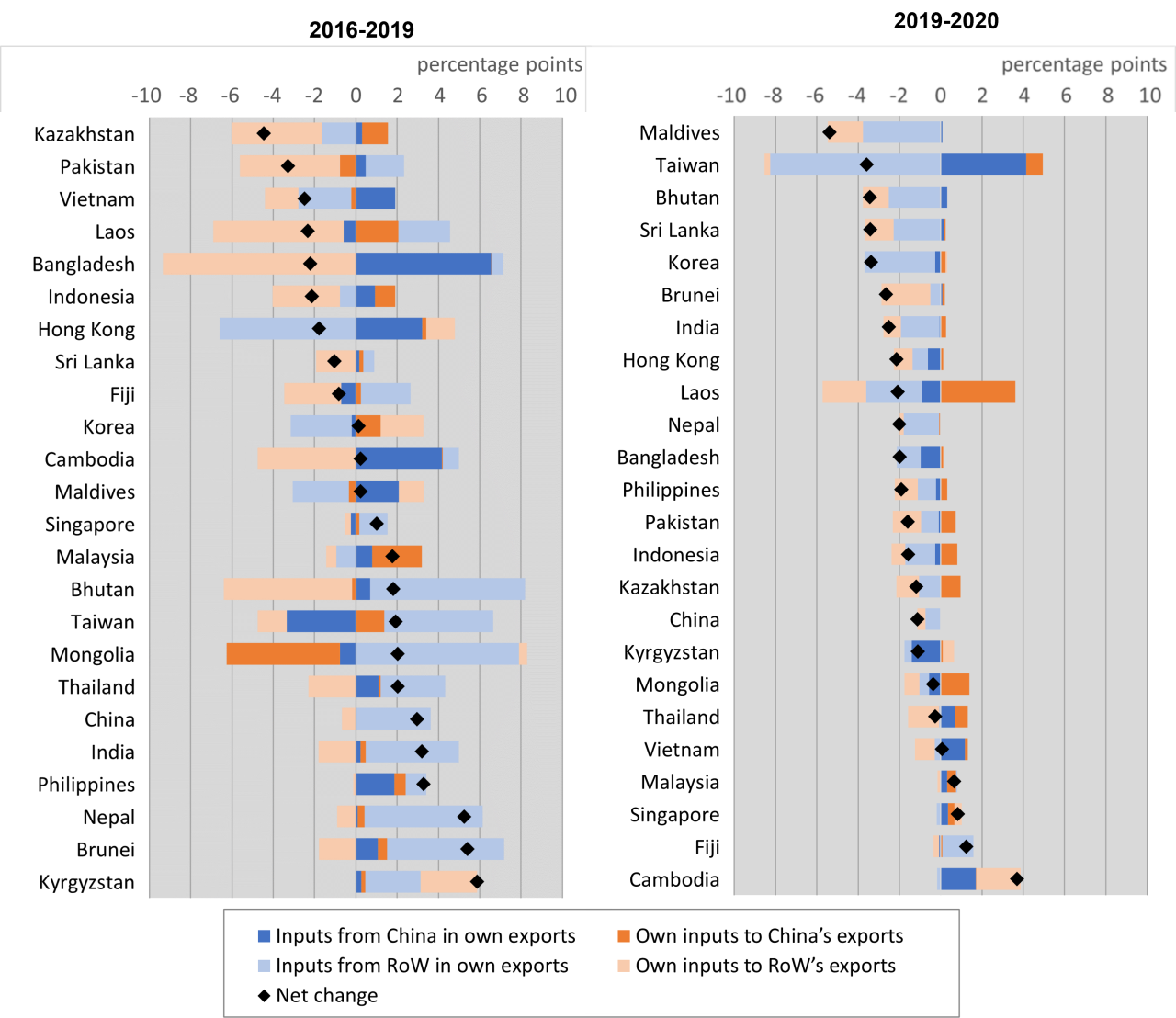

As shown in the left panel of Figure 2, the rising intra-regional trade in intermediates (dark orange bars) notably benefited Korea and Taiwan, which host large semiconductor manufacturing industries. Regional exports of intermediates to the rest of the world (light orange bars) declined, particularly from Malaysia and Vietnam, making China even more critical as a destination market for Asian intermediate manufactures.

The relative role of China in supplying inputs to regional partners declined. Value-added exports of inputs by China to the rest of developing Asia (dark blue bars) increased by 45% during 2016–2019, slower than exports of inputs to the region by Japan (57%), Europe (77%), and the US (143%). Across economies, this decreasing reliance on inputs from China is illustrated by dark blue bars being shorter than light blue bars (e.g., Thailand) or dark blue bars even going negative (e.g., Taiwan).

|

Figure 2. Changes in Cross-Border Value Chain Participation Changes are reported as percentage point differences in participation rates. |

Regional value chains cushioned the impact of the pandemic in 2020

Resilient regional supply of intermediates kept downstream industries afloat as the pandemic hit. In 2020, developing Asia’s imports of inputs declined by 11% from Europe, and 14% from the US. In contrast, imports of inputs from China declined by only 1.0%, while they rose by 0.3% from the rest of the region. The resilience of regional sourcing thus mitigated the decline in imports from non-regional suppliers. As shown in the right panel of Figure 2, across economies imports of inputs generally decreased in 2020 (negative blue bars). But imports of inputs from China still increased in Cambodia, Taiwan, Thailand, and Vietnam (dark blue bars), helping these economies navigate through shortages in inputs.

Resilient Chinese exports of final goods kept upstream industries afloat. Regional sales of intermediates to China increased by 6% in 2020, while sales to Europe fell by 4% and to the US by 10%. Commodity exporters such as Laos and Mongolia suffered from declining sales outside the region (negative light orange bars), but rising purchases by China partially offset these declines (dark orange bars). The decline in global demand for intermediates was milder for exporters of manufactured intermediates such as Singapore and Thailand but there also, Chinese exporters mitigated the slowdown by increasing purchases of inputs. This resilience in China's demand for intermediates was due to its strong rebound after March 2020, driven by global demand for electronics.

Regional value chains drove the recovery from the pandemic in 2021

Developing Asia’s exports of intermediates grew across all destinations in 2021. Sales of inputs increased the most to Japan (70%) and to the rest of developing Asia (45%), reflecting catching up from the previous year’s fallout. In contrast, regional exports of intermediates to China recorded only 2% growth in 2021, given base effects against China's resilience in 2020. Chinese sales of intermediates, on the other hand, rose by a staggering 53% in 2021, driven by the recovery of manufacturing elsewhere in the region.

Conclusion

Value chains regionalized in developing Asia as China-US trade tensions mounted, reinforcing China's role as a supplier of intermediates. Value chains further regionalized with the pandemic as China cushioned the impact by providing an outlet market for exporters of intermediates and ensuring continuous supply of inputs for downstream industries. Chinese resilience across both episodes thus helped the rest of developing Asia withstand shocks. But conversely, these value chain linkages would stand to weaken regional economies if a negative shock were to hit China. To mitigate this risk, investors and policymakers should ensure that the supply chains in which their businesses and countries are involved are sufficiently diversified.