Co-Author: Madan Dhanora

“Need to focus on 5 things to bring India back on growth path – Intent, Inclusion, Investment, Infrastructure and Innovation,” Prime Minister Narendra Modi said while delivering the inaugural address at the Confederation of Indian Industry Annual Session 2020 – “Getting Growth Back”. Among the 5 I’s, we focus on innovation in the private sector which is stalling in India. As per the Department of Science and Technology, only 42% of total R&D spending was by the private sector during 2016-17, while in developed economies like the United States and another emerging economy, China, a larger share of R&D spending comes from business enterprises – upwards of 60-70% of total R&D expenditure in each. The contribution of 42% in India, though not on par with international magnitudes, has increased considerably from 19% in 2001-02. This increase may be attributable to liberalization and other policy initiatives to stimulate innovation including reforms in intellectual property rights.

In developed economies, competitive pressures push companies to engage in R&D and patenting activities. Although liberalization in India has ostensibly paved the way for greater competition, the nature of that competition is such that innovation activity is still being held back. Our study published in Economics of Innovation and New Technology (2020, Issue 2) distinguishes between firms that compete neck-and-neck for technological leadership in an industry and those that lag substantially behind an industry leader. We find that laggards are generally not very technologically savvy and thus do not pose a credible threat to the leader. Leading firms that do innovate when faced with little competitive threat from laggards tend to be large and mature, and innovate for strategic reasons. By contrast, for industries with neck-and-neck competition, such as chemicals, pharmaceuticals, and electrical equipment, firms are forced to compete on the basis of innovation. India’s legacy of regulation continues to influence the type of competition in an industry allowing leaders and laggards to co-exist. Competition of this nature will not drive innovation. The competition needs to be intense in terms of low technological differences among firms.

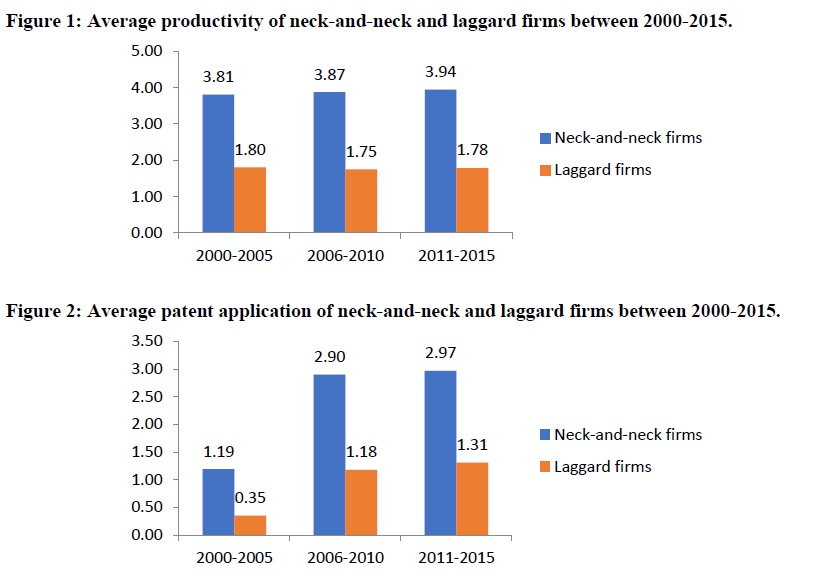

Figures 1 and 2 show average productivity and patent applications for neck-and-neck versus laggard firms over the period 2000-2015. Both productivity and patent application are much higher for neck-and-neck competing firms than for laggard firms.

These research findings raise two questions. First, why does so little private sector innovation take place in India and second how can firms be incentivized to invest in R&D? Clearly, until and unless India develops a culture of innovation, the country will not be able to achieve a high contribution from private sector R&D. To understand underinvestment in innovation by average firms, the analysis by Haskel and Westlake (2019) of investment in intangibles is instructive. They argue that investment in intangibles is influenced by economic characteristics that include scalability and spillover. For a firm to reap full benefits from an investment in R&D, it needs to be able to scale up production. For instance, new software developed by an aggregator firm will enjoy the greatest benefit from scaling. Spillover refers to non-appropriable knowledge that results from innovation activities like R&D and patenting such that other firms benefit without having to pay. Knowledge can spill over to other firms through worker mobility, demonstration effects, and forward and backward linkages. Spillover reduces the motivation to invest in R&D, especially for a laggard firm that may not be able to reap full benefits. For firms that find it difficult to scale up and are incapable of containing spillovers arising from their own R&D, innovation will be discouraged.

What, then, is the way ahead for public policy? The need of the hour is to build knowledge infrastructure. This can be encourged by publicizing and enforcing clear intellectual property rights. In terms of intellectual property law, India has the legal framework but must bring awareness to industry. For instance, only a few years ago the Indian Patent Office (IPO) issued guidelines for the patentability of software. Though IPO raised its examination rate by 108% in 2017-2018 (Annual Report, Indian Patent Office), it still received a meagre 50,055 applications in 2018 (WIPO 2019). By contrast, in the same year, China’s intellectual property office received 1.54 million applications amounting to 46.4% of the global total. As the number of applications in India is expected to grow, IPO will need to be prepared to deal with the influx. This brings us to the dismal number of applications and how to boost it. Various central government and state level organizations along with Industry partners are involved in spreading awareness about patenting. However, the impact of such schemes remains unknown. Often, attendees appear at outreach workshops for name sake only. Hence, there is a need to evaluate patent related awareness among firms and accordingly devise schemes to incentivize them to innovate and seek patents. Public spending on science and technology to facilitate synergies among firms is another approach that needs to be boosted. Until and unless India manages to spread the culture of innovation to small and medium firms, it may miss the opportunity to lead in new technologies with resulting compromise to its growth prospects.

___________________________

Co-author Madan Dhanora is Assistant Professor of Economics at Government Mahaveer College, Petlawad, Madhya Pradesh, India.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.