Co-Author: Monzur Hossain

Small businesses in Bangladesh are usually started out of necessity and operate informally. They generally lack access to bank credit, possess little capital, and sell their output locally. The very nature of these small businesses makes them extremely vulnerable to the shock of COVID-19.

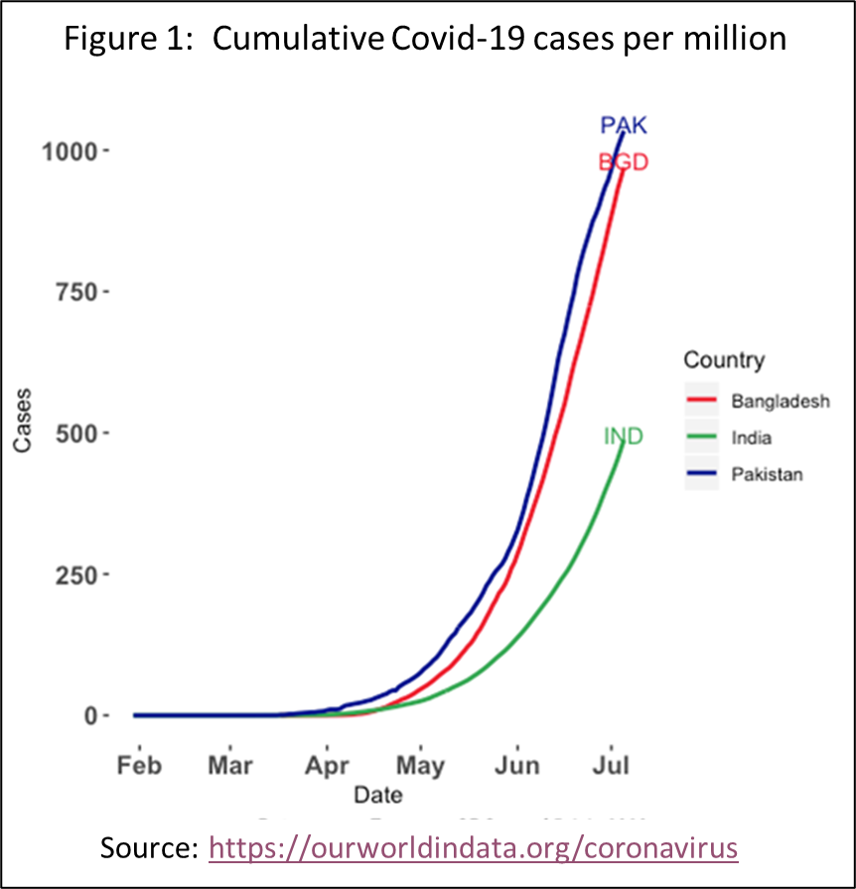

As of the end of June, a total of 145,483 cases of COVID-19 had been identified in Bangladesh, with 1,847 people having died. Cumulative case per million population in Bangladesh are slightly lower than in Pakistan, but much higher than in India, as shown in Figure 1. Recent trends in the daily number of cases suggest that the country is still far from slowing down the pandemic. The economy is thus in for a difficult time ahead.

In Bangladesh, micro, small, and medium enterprises (MSMEs) contribute about 25% of GDP, comprise over 95% of industrial units, and provide 86% of industrial jobs. In 2019, there were 1.3 million SMSEs responsible for about Tk. 400 billion a month in sales and Tk.60 billion a month in wages. These numbers give us a rough idea of the potential losses of MSMEs due to lockdown under the pandemic. Many MSMEs have been forced to stop production even as they continue to incur costs in the form of wages, utility bills, rent, etc. Without assistance, most will not be able to absorb these costs beyond one month into the shutdown.

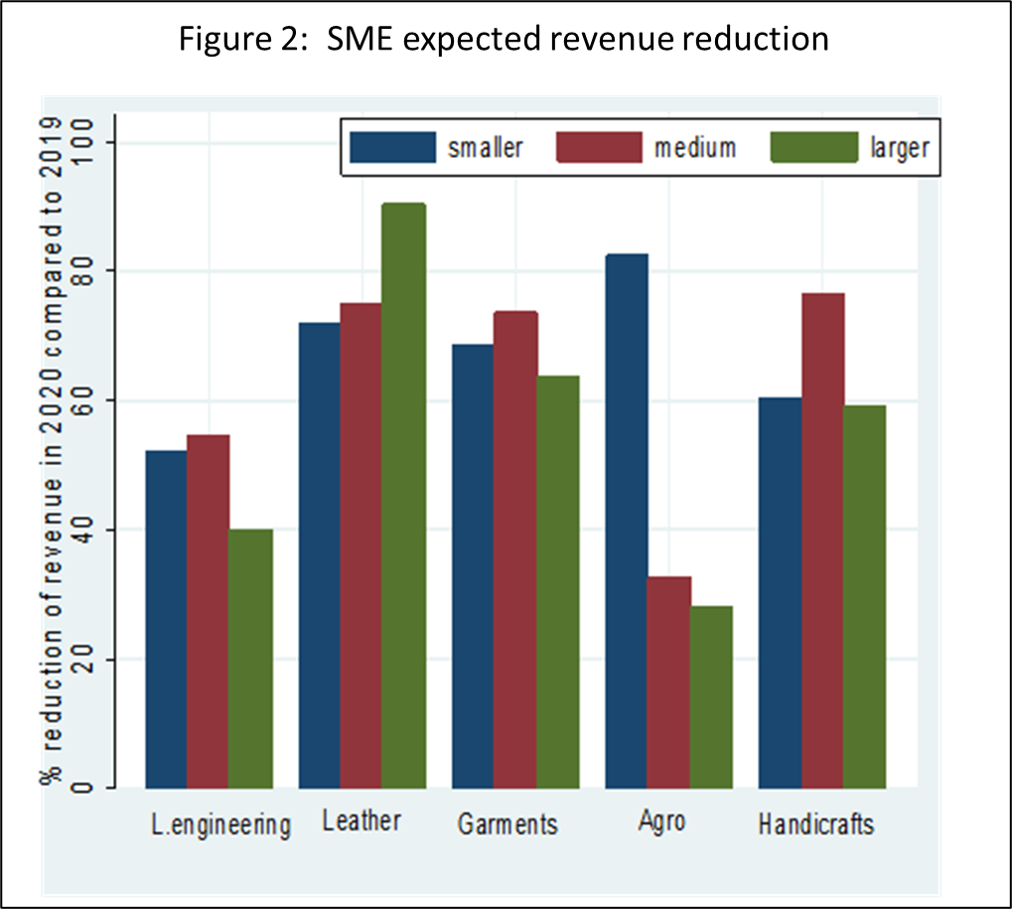

To get a sense of expectations regarding losses within SMEs, a survey was conducted encompassing 375 businesses and 365 workers. The survey was carried out by telephone from 26 April to 10 May 2020.The sample was drawn from 15 regional clusters mapped into 5 industrial sectors: electrical, light engineering, and plastics; leather processing and goods; garments; agro-processing; and handicrafts.

Survey results were presented by the authors at a webinar sponsored by the Bangladesh Institute for Development Studies. The summary finding is that SME owners expect revenue reductions in 2020 relative to 2019 to reach 66% on average. As shown in Figure 2, expected revenue losses vary by industrial sector and by enterprise size measured in number of employees. The most severely impacted groups, with expected revenue losses of more than 80%, are large manufacturers in the leather sector and small operators in the agro-processing sector. Medium and large operators in agro-processing, by contrast, expect the lowest losses at about 30%. Their relatively strong expectations presumably derive from demand for food products remaining resilient through the pandemic. That small agro-businesses anticipate being hit so hard may reflect supply and marketing disruptions. Leather, garment, and handicraft businesses generally expect revenue reductions of 60% or more. These are sectors in which purchases are more discretionary, with demand thus likely to fall. In the electrical, light engineering, and plastics sector, expectations are for revenue losses of around 50%.

For many businesses, continued viability is in question: 41% fear they will have to close if the shutdown continues for two more months while 48% imagine they will survive but with huge losses. Unpaid receivables are a problem for 73% of firms with little hope of recovering the money soon. At the same time, 75% report unsold inventory due to the shutdown. When the economy does emerge from shutdown, supply chain disruptions are expected to cause delays of a month or so in getting back to full production. As of late Arpil or early May, salaries for March had been paid either fully or partially in 98% of cases. However, about two in three workers doubted they would be paid in May.

In support of MSMEs, the government on April 5, during the second week of lockdown, declared a stimulus package of Tk. 200 billion. Support to businesses will be delivered in the form of bank loans at 9% interest with the government providing a 5% interest subsidy. However, since only about 30% of MSMEs have access to bank finance (BIDS survey 2017), implementation of this package will pose a challenge.

For effective implementation of the stimulus package with a view to the distress that MSMEs are under, we offer the following ten recommendations.

______________________

Co-Author Monzur Hossain is a Senior Research Fellow at the Bangladesh Institute of Development Studies, Dhaka, Bangladesh.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.