When the last global crisis hit in 2008-09, the major economies of East Asia, but for one, had ample fiscal space to respond, and took advantage of that. This time around, the positioning is more mixed and the threat potentially much greater.

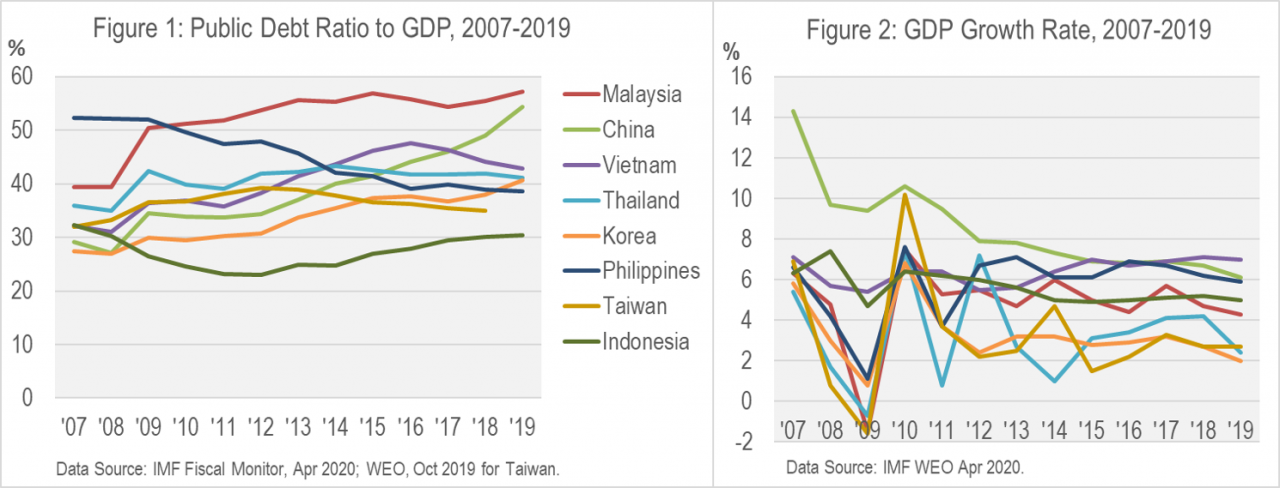

In Asia, the shock of the Great Financial Crisis (GFC) was inflicted mainly through export loss and capital flight. Domestic financial systems remained sound and productive capacity intact. A quick shot of fiscal stimulus was just the remedy to tide an economy over until global trade rebounded and financial capital returned. Use of such a strategy shows up in Figure 1 as a sharp increase in the debt-to-GDP ratio in 2009 for Malaysia, China, Vietnam, Thailand, Korea, and Taiwan, with the ratio then declining or stable in 2010. Two countries – the Philippines and Indonesia – saw no increase in their debt ratios in 2009, riding out the crisis without recourse to fiscal stimulus.

The Philippines had the highest debt ratio of the lot at 52.1% of GDP going into the GFC, which crimped its space for fiscal stimulus. Yet even without the policy action of its neighbors, the country managed a less severe downturn than most in 2009 and as sharp a rebound in 2010, as shown in Figure 2. A relatively low dependence on goods exports was an advantage in weathering the shock. Over the next decade, the Philippines engineered a steady decline in its debt ratio to 38.6% of GDP in 2019, a feat all the more remarkable in that it was off a peak of 74% in 2004. The Philippines had at that point gotten itself into a dire fiscal predicament (Diokno, 2010). A tax reform program had depleted revenues forcing a combination of expenditure cuts and heavy borrowing. Further adding to the debt burden, the government took on obligations of poorly performing public corporations and financial institutions. Debt service expenses burgeoned to reach 76% of tax revenues. Arriving at the current sound fiscal footing has required serious discipline. The Philippines now finds itself exceptionally hard hit by the pandemic, its GDP down by 16.5% in the second quarter even as growth in much of the region has remained positive (Punongbayan, 2020). If ever there were a time to take advantage of fiscal space, this is it. Yet the President's repeated refrain in response to pleas for public assistance has been "we have no more money" (wala na tayong pera) (e.g., CNN Philippines). Meanwhile, legislators continue to debate modest proposals (Rivas, 2020).

Malaysia's debt ratio has tracked in the opposite direction of the Philippines'. To counter the impact of the GFC, the government took on additional debt amounting to 11% of GDP. The economy nonetheless contracted by 1.5% in 2009, to then rebound in line with the region in 2010. In the ensuing years, deficits remained high enough at 2.5-3.6% of GDP to push the debt ratio up to 54.4% by 2017, according to IMF statistics. An assessment undertaken by the new government that came to power in May 2018, however, revealed a more full-fledged measure to have reached 79.3% (Ministry of Finance Malaysia). This figure includes "off-balance sheet financing to cover up dubious debts" including those held by the scandal ridden sovereign wealth fund 1MDB. This rather lofty debt ratio notwithstanding, the Malaysian government has announced an aggressive fiscal response to the pandemic. The fiscal deficit originally budgeted at 3% of GDP is now projected to reach 6% (Reuters). Malaysia has a statutory debt ceiling of 55% of GDP that the Finance Minister says should be raised if need be to accommodate the stimulus package.

Like Malaysia, China must confront the current crisis with an already high debt ratio, higher even than the official measure manifests. The IMF estimated an "augmented debt ratio" of 73% for 2018 and projected this ratio to rise above 100% by 2024 even without the pandemic (Article IV, p.16). Concerns about China's off-budget public debt date back to the country's strong response to the GFC when much of the stimulus was funded by bank lending to local government investment vehicles. Thereafter, public debt continued to accumulate at a rapid pace, as did private debt, with no let up in warnings about impending crisis by outside observers. A recent book by Tom Orlik (reviewed on this blog) explains why no crisis has occurred and argues that none is imminent. Orlik maintains that China is able to carry a large debt load due to its high domestic savings and constraints on cross-border capital flows. Savings are held mainly in the form of deposits at state banks, and these banks in turn are major buyers of government bonds. This arrangement allows the Chinese government to borrow at low interest rates with no danger of investor panic or capital flight. In response to the pandemic, which reduced China's first quarter GDP by 6.8% year on year, the government announced a fiscal package involving a budget deficit of 3.6% of GDP plus off-budget bond issuance at central and local levels (Huang & Lardy, 2020). High though it be, the debt ratio does not seem to be binding.

At the opposite end of the spectrum from China and Malaysia, Indonesia had a public debt ratio in 2019 of just 30.4% of GDP. The caveat is that more than half this debt is held by nonresidents with much of that denominated in foreign currencies implying risk due to capital flight and rupiah depreciation. Indonesia's fiscal space is constrained by weak domestic financing capacity. Indeed, a recent bond issue to fund the pandemic response was met in part with direct central bank monetization. A Finance Ministry official described this as "the first time that Bank Indonesia bought sovereign debt papers to support the financing of non-public goods" (Akhlas, 2020). Indonesia saw its GDP contract by 5.3% in the second quarter due to the pandemic. Government revenue will be dragged down not only by a shrinking tax base but also by falling oil prices. The fiscal deficit for 2020 is projected to reach 6.3% of GDP even without a major spending program.

The remaining countries of Vietnam, Thailand, Korea, and Taiwan have done well in containing the virus and diminishing its economic impact. With debt ratios of around 40% of GDP or less, they have comfortable fiscal space to absorb negative shocks to revenue and implement active spending programs.

In conclusion, countries that have high public debt ratios – Malaysia and China – are mounting concerted stimulus efforts in response to the pandemic. These countries are able to finance additional government borrowing easily enough and to mobilize spending quickly. Conversely, countries that have low public debt ratios and, moreover, have been especially hard hit by the pandemic – the Philippines and Indonesia – have been restrained in their fiscal action, as they were with the last global crisis. In the Indonesian case, a low public debt ratio may not actually mean greater fiscal space. In the Philippine case, fiscal space does not now appear to pose a limitation on a well managed fiscal response. In general then, factors other than the public debt ratio seem to be guiding fiscal policy.

__________________

Related post: 'The New Fiscal Consensus' As Per Blanchard & Subramanian Interpreted for South East Asia, 7 February 2021.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.