With the August 28 announcement by Prime Minister Abe of his intention to step down from his position within weeks, his record in a number of areas will inevitably face scrutiny and evaluation. Here, I lay out, in brief, my views on his government’s macroeconomic policies, which quickly became known as Abenomics. Like most governments, his had both successes and missed opportunities. But Japan clearly has changed as a result of his economic policies. And the debate around Abenomics anticipated issues that remain highly relevant in the current global policy debate.

The context

It is important to recall that, at the start of the Abe government at the end of 2012, Japan was widely seen as a basket case. Although this view was always too pessimistic—e..g. Japan’s per capita growth was broadly in line with other advanced economies—there were enormous challenges. The combination of an aging and shrinking population, declining potential growth, and rapidly rising public debt pointed clearly to the need for a new approach. And the recovery from the 2011 Tohoku earthquake and tsunami was still ongoing.

Abenomics represented a comprehensive approach to revitalizing Japan’s economy, characterized by the three so-called “policy arrows”: aggressive monetary easing; a “flexible” fiscal policy; and deep structural reforms to raise potential growth. The idea was that monetary easing and a shift in inflation expectations would lower real rates, spurring domestic demand, while a (possibly temporary) depreciation of the yen would support exports. Aided by lower real borrowing rates, the government would provide a fiscal stimulus, while developing a medium-term consolidation plan. Structural reforms would help raise growth and ease the public debt burden. As noted by the government at the time—and emphasized by the IMF, academics, and others—success would require the firing of all three of these complementary arrows.

So what happened?

Monetary policy

|

|

| All charts are from IMF Article IV Consultation 2019. |

The new monetary policy framework announced in April 2013 was a major departure from the previous incremental approach. A 2 percent target was announced, to be reached within two years. Asset purchases were increased and broadened, and forward guidance aimed to strengthen confidence in this new framework. A joint announcement of policies by the government and BoJ troubled some at the time, but aimed to emphasize the complementarity of policies. Some seven years later, the idea of coordinated monetary and fiscal policies is no longer a novel one.

Early signs were positive. Inflation rose—but largely on a sharp depreciation—while inflation expectations turned positive, quickly reaching about 1½ percent. In the years since, inflation has stayed positive, in contrast to the previous decades, but has never come close to its target (except in the immediate aftermath of consumption tax hikes) despite further expansions of asset purchases, negative interest rates, and yield curve controls. And the path of inflation expectations suggests that the 2 percent target was never fully credible.

It has been argued that the difficult demographics of Japan have limited the impact of monetary policy on inflation. But, virtually all advanced economies have found it impossible to meet their own (often 2 percent) targets despite historically expansionary monetary policies. In Japan’s case, it seems likely that the monetary arrow has had a beneficial impact on inflation, real rates and growth although not to the hoped-for extent.

Fiscal Policy: Spend Now, Save Later?

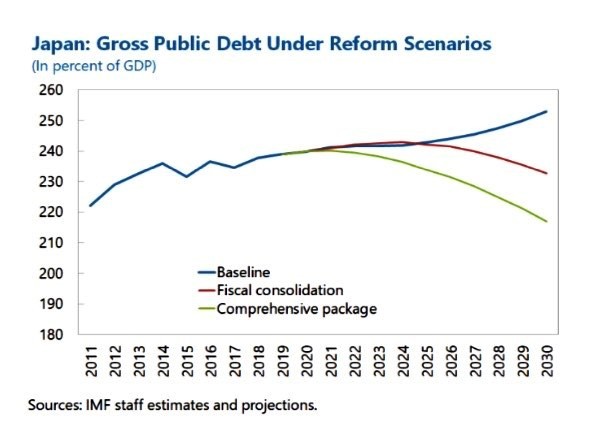

Fiscal policy under Abenomics has struggled with achieving a balance between supporting growth and ensuring debt sustainability. By 2012, gross debt had already reached some 240 percent of GDP, highest among advanced economies and the fiscal costs of an aging society made the outlook bleak. But—as has been experienced by countries around the globe—borrowing rates have remained low, aided by massive central bank purchases. There have been periods of fiscal stimulus, but any impact may have been moderated by the lack of a clear medium-term fiscal framework. The government did implement one 3 percentage point consumption tax hike in 2014 and another—after several delays—in 2019. Gross debt-to-GDP has remained broadly constant since 2012, while the tax hikes and low global rates have bought time for a larger fiscal adjustment. Of course, the Covid-19 crisis has blown a hole in Japan’s deficit, as in most countries, and large fiscal challenges remain.

Structural reforms

Pre-2012 Japan had seen no shortage of growth strategies without any visible impact on actual growth. Abenomics aimed to do better by addressing some of the most fundamental roadblocks to growth. There was considerable skepticism about what was politically possible—despite a large majority in both houses of the Diet—and that skepticism does seem to have been partially borne out. Nevertheless there have been some qualified successes, including the following:

Conclusions

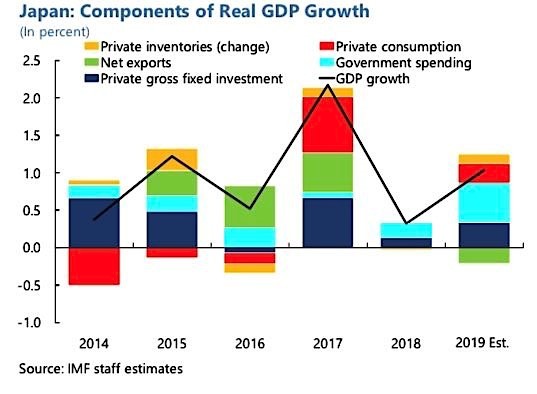

When one takes into account the trajectory of, and prospects for, the Japanese economy by 2012, it seems likely that Abenomics has been, on net, a beneficial set of policies. Growth has remained at around one percent in most years, less than hoped for, but perhaps not too bad in light of the shrinking working-age population and a generally weak global economy. Monetary policy has remained appropriately expansionary throughout and is likely responsible for the critical escape from deflationary forces. But the inflation target remans unmet and it is difficult to see a lot more room for accom-modation from the BoJ.

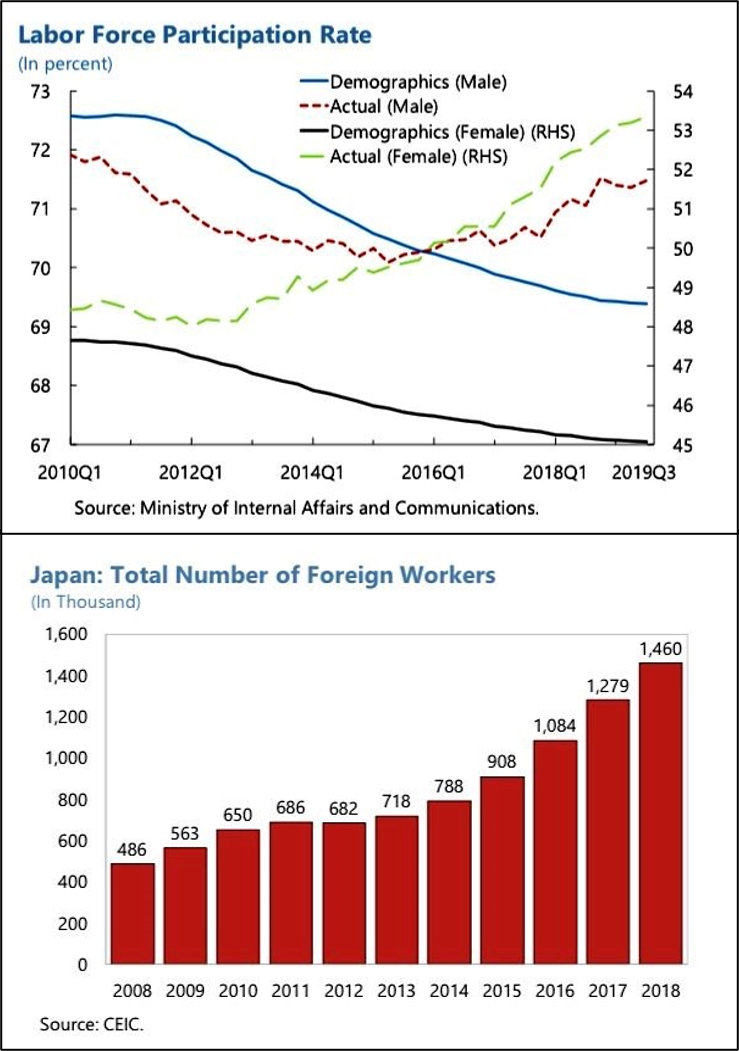

On the fiscal side, some progress has been made toward debt sustainability with two tax hikes, but the debt burden remains problematic, especially should the impact of the current Covid-19 crisis lengthen or the period of low real rates come to an end. Labor shortages have been addressed to some extent, via increased labor force participation and greater use of foreign workers, but Japan remains a laggard in both areas. And while corporate governance has been reformed, there is not yet an obvious payoff in terms of corporate investment.

Whatever the gains from Abenomics, it is clear that Abe’s successor has plenty of economic challenges remaining.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.