In recent years, emerging market countries—in particular, those in Asia—have been among the global economy’s star performers. Even during bad times, such as during the Global Financial Crisis, Asian EMs have seen their economies hold up better than most others.

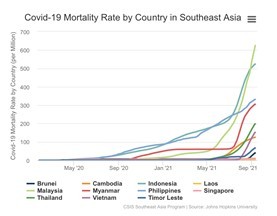

For much of the COVID crisis, that story held true. Many Asian economies, such as Vietnam, Singapore and Taiwan, seemed to have COVID under control, while Asian EMs appeared to have significant monetary and fiscal policy room to help address any economic impact of the crisis. In April 2021, the IMF’s projections for growth in the region were extremely bullish, with a recovery to 8.5 percent growth in emerging Asia this year and 6.0 percent in 2022. Two months later, expected growth had been downgraded, to a still-healthy 6.3 percent and 5.2 percent over the same two years (see Table). The ADB was even more optimistic in its July 2021 projections, pointing to growth of 7.2 percent and 5.4 percent this year and next.

For much of the COVID crisis, that story held true. Many Asian economies, such as Vietnam, Singapore and Taiwan, seemed to have COVID under control, while Asian EMs appeared to have significant monetary and fiscal policy room to help address any economic impact of the crisis. In April 2021, the IMF’s projections for growth in the region were extremely bullish, with a recovery to 8.5 percent growth in emerging Asia this year and 6.0 percent in 2022. Two months later, expected growth had been downgraded, to a still-healthy 6.3 percent and 5.2 percent over the same two years (see Table). The ADB was even more optimistic in its July 2021 projections, pointing to growth of 7.2 percent and 5.4 percent this year and next.

It now appears unlikely that emerging Asia will come close to these projected growth levels. There are several reasons for this:

Inflation has risen in much of the global economy, and emerging Asia is no exception. In part, this reflects possibly transitory effects of supply chain disruptions and sharply rising shipping costs, which have also impacted exports from the region. But central banks will likely feel the need to address concerns about rising prices, perhaps following recent rate hikes in Korea, Turkey, and Russia. At a minimum, the likelihood that central banks will offer significant policy support in the current environment seems to have declined considerably.

Inflation has risen in much of the global economy, and emerging Asia is no exception. In part, this reflects possibly transitory effects of supply chain disruptions and sharply rising shipping costs, which have also impacted exports from the region. But central banks will likely feel the need to address concerns about rising prices, perhaps following recent rate hikes in Korea, Turkey, and Russia. At a minimum, the likelihood that central banks will offer significant policy support in the current environment seems to have declined considerably.None of this is to say that Asia will be plunged into recession or that it won’t continue to outperform other regions of the world. Nevertheless, the optimism of spring and summer now seems very much overdone, while the challenges to macroeconomic policy-makers have grown significantly more complex.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.